|

Excel Templates Categories

Popular Free Excel Templates Warehouse Inventory Management Templates Excel 2016  Customer Ranking Tool Excel 2003 or newer Employee Training Tracker Spreadsheet Template Excel 2013 or newer  12 Month Profit And Loss Excel 2007 or newer  Income Statement Excel 2007 or newer  Manufacturing Overhead Budget Excel 2007 or newer  Excel Loan Comparison Calculator Excel 2013 or newer |

Free Excel Templates, Chart, Calendar, Budget, Invoice Spreadsheet Template

Many people including us are not very good in juggling numbers and spending money, so they will go for free excel templates in just the necessary need so it is always hard to resist the fallacy need of buying less important things which then lead us to the urgent need to use the financial planner and free excel template. Ms. Excel is broadly used to the number processing program in your computer which then being modified to accommodate the need of having a financial planner for a business, household, education, and personal money matter. In some ways it is not necessarily important if you are already good in keeping up with tight budget lifestyle and even having your own accountant to deal with your business spending and personal spending. But for many that have less cautious of spending money and at the same time wants to save up some money, a planner and excel budget template to help you manage it all.

What is the advantage of using a planner? Why should we use the planner? How we can find the free excel template? These questions may find their answer here.

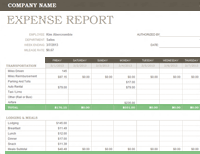

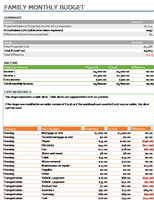

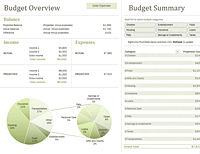

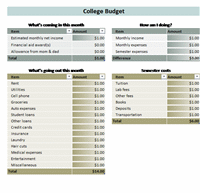

The purpose of using a budget planner is that you will have the vision of how much you will earn next month and how you will send it wisely. You can also combine it with gantt chart excel template to track the progress of your target. Some are using weekly planner while other choose to use the monthly planner to help them sort the need of each month and see the increasing or decreasing needs of each month and evaluate per month in general. The free excel template is the best friend to create excel template for the planner. You can list up your income of every month and then the three spending you will do each month. What are those incomes and three different spending? Income is what you earn each month based on your job and other source of money. For example you have small business that earns you money each month, or a rent payment from someone who rent a flat from you. Add all those up with your monthly income to the income area. If you have a partner, the income of your partner and his or her other side income can also be added up to the income aspect. If you are a freelancer or someone who works in the on and off seasonal business you should consider of using the lowest income from the last 12 months or the average income from the past 12 months too. It helps you to set up the spending under or even with the income. You can use cash flow template to forecast 12 months or yearly cash flow generation and if you looking for weekly cash flow forecasting, you can use this weekly cash flow template. Another aspect that should be counted is the spending. The primary spending should go to what it very urgent such as paying rent, electricity, paying the water supply, tax, transportation, and paying insurance. While the secondary spending is on what you spend every month but the amount is not static. For example, like groceries, fuel, credit card debt, and etc. while the last that should be counted into the free excel template is the discretionary spending. This is the spending that doesn’t count into your primary and secondary spending and typical prompt spending, like a Mac and Cheese that you bought on your way home after work and caught up in a traffic jam after working hours. Or the spending you did on the new purse with 50% sale in Charles & Keith. Something you clearly do not need and do not want for your daily basis life but still buy anyway because the external factors like the 50% sale. These spending, even though you don’t need it, still should be written on the free excel template to remind you of this excessive waste of money and not to do it again next month. Now only using the planner to plan your day to day financial managerial, you need to also have the excel invoice template. If you own a business, using invoice is something necessary. You need to be clear about the payment of the service you give or the product you sell to the client or customers. Not only for the financial accounting purpose, the invoice also adds the professionalism sense on your business to your client, that you are serious of running the business in the proper way and that they should respect the due date to pay your service or your product as soon as they receive the filled invoice. The income you get from sending out your invoice to the client should also be counted to the free excel template planner as your income. Otherwise it will be the missing source money that you might waste in ease as the extra money you earn outside the income while it is part of the income itself. If you are not sure you can create your own excel planner, do not worry since there are numerous sources in internet that provide you with the free excel template planner online. You can download those and start using it as your personal weekly or monthly excel planner. You can browse our website for example that provides you with excel template for your personal use, household financial management, and the small business financial accounting. Not only for the free excel planner. Making invoice from one business to another business can be very different so you need to find the specific invoice and excel planner that will cover the work that you have done to your client and sums up all the income and outcome. Given that circumstances, be careful while you are looking for the perfect excel planner for your business. The excel planner for personal and household could be pretty much covering same things but for business it will be different based on the type of the business and the flow of the cash so does the typical of the payment provided by the business and by the clients. Find the perfect excel planner and and expense report template start managing your budget easily.

|

Latest Excel Templates TutorialRequested Excel TemplatesTop Rated Excel Templates Accounts Receivable Aging Excel 2007 or newer  Income Statement Excel 2007 or newer  13-week Cash Flow Model, Basic Version Excel 2007 or newer  Small Business Cash Flow Projection Excel 2003 or newer  Rolling Business Budget And Forecast Excel 2003 or newer  G & A Expense Budget Excel 2007 or newer  Pro-forma Income Statement Excel 2007 or newer |

Free Excel Templates

Free Excel Templates Latest Excel Templates

Latest Excel Templates Most Popular Excel Templates

Most Popular Excel Templates Top Rated Excel Templates

Top Rated Excel Templates Request Excel Templates

Request Excel Templates